Entrepreneurs are migrating to the technology advisor ecosystem, driven by vendor layoffs and partner consolidation. The opportunity to build a business from the ground up is spurring the trend.

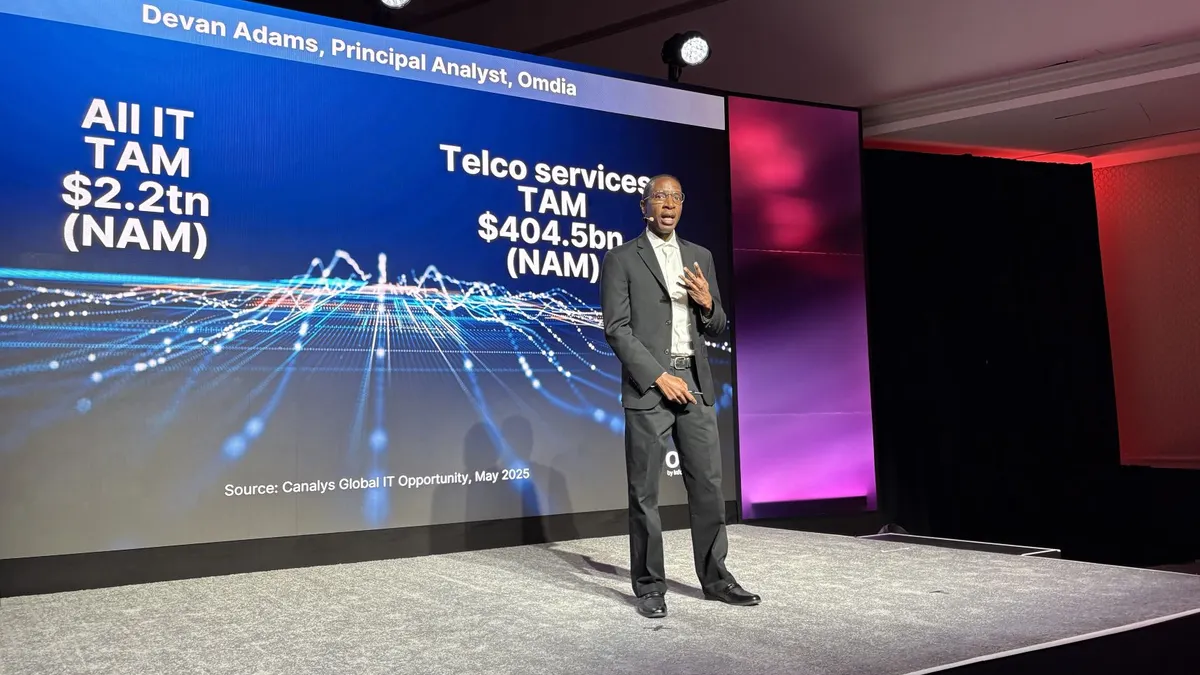

TAs, also called agents, are a niche within the indirect technology channel. They broker cloud and carrier products and services, serving as go-betweens in IT procurement. Somewhere between 8,000 and 13,000 active TAs exist, according to estimates provided on background to Channel Dive by key technology services distributors.

The latest wave of TAs is the product of tech sector turmoil. Many have left sales jobs, ditching corporate quotas to source a multi-vendor portfolio.

The change corresponds with a generational shift as established TAs exit the business.

An influx of private equity has given veteran TAs a path to retirement and created an opportunity for partners to enter the market.

“What it tells them is, 'Hey, I can really build value for myself, for my family, for my future.’ Because in the past, the folks that are retiring here didn't have a clear path,” said Adam Edwards, CEO of tech services distributor Telarus.

TSDs are a piece of the puzzle.

Edwards said 40% of Telarus’ advisor partners are new to working with a TSD, evidence that the industry is replacing people leaving the business.

“To the people concerned about those exiting, I don't think they're close enough to the people who are entering,” Edwards said. “It's hard to see what success is early on, but we're seeing signs of it everywhere.”

The telecom pipeline

The TA channel has its roots in carrier sales.

Most TAs emerged from the telecom industry with foundational experience in connectivity. Many went solo because they hit a cap on their commissions. Some wanted independence.

Others left because they were pushed out. Dot-com bubble era layoffs sent top sellers and project managers onto the street.

When Cable & Wireless exited the U.S. market in 2003, it was a blessing in disguise for future entrepreneurs.

“They literally locked the doors one day,” said Avant Communications CEO Ian Kieninger, a former AT&T seller. “That spawned some of the best TAs we have ever seen in this space, and they're still here.”

Layoffs are ever present in the IT sector. Verizon shed 13,000-plus people last week, and Amazon cut 14,000 last month.

Competitive local exchange carriers produced some of the best agents, according to Edwards. With CLECs now a relic of the past, other vendors are unwittingly preparing future advisors.

Examples abound. Cloud Latitude founder Chris Mooney, for example, previously led sales at private cloud provider Rackspace. Bridgepointe's Homa Shaner previously directed sales at SASE provider Aryaka. Nabila Lulow won Presidents Club three times at a contact center software provider before moving to the partner side.

Ultimately, direct sellers don’t control their own destiny while working for a vendor, Lulow said.

“You kill it one year, and then the next year, your quota gets increased like 20%, and that's so stressful,” said Lulow, who recently founded Seattle-based NobleOne Consultants. “Now I have the ability to really control what ‘good’ looks like for me.”

It’s especially appealing for salespeople who are highly involved with their clients. In a direct sales role, Lulow was responsible for ensuring successful product deployments, but was only paid for the initial booking.

TAs are paid on a monthly basis, which incentivizes Lulow to go deep and wide with the customer.

“You still have the same responsibility and the same risk, but the reward on the other end is much greater,” she said.

A friendly market

Minerva Tec Group CEO Anita Patel was greeted by a TA-friendly U.S. market when she arrived from the U.K. a few years ago.

Patel co-owned a British agency from 2013 to 2023 before launching Minerva in Florida. Her experiences have varied widely in the different regions.

The U.K. agency was formed directly out of a 2013 carrier initiative. A large telco — and Patel’s former employer — converted several of its direct sales people to agents.

The arrangement came with benefits for both parties. The agents had control over their compensation, while the carrier reduced its overhead and helped stabilize costs.

The arrangement came with strings attached. The supplier exerted strict control over her business, setting quotas and clawing back enterprise accounts.

Minerva has encountered no such restrictions, largely because U.S. vendors sell through agents, which gives the company leverage. Patel has expanded the business to include unified communications and cybersecurity.

Patel advises clients on network, UCaaS and cybersecurity. Her firm has cultivated vertical expertise with senior living organizations.

It’s an aspiration many salespeople think about but never get around to doing, Lulow said.

“You're either going to invest in yourself and your destiny long-term, or you're building somebody else's dream,” she said.