Dive Brief:

- A first-of-its-kind report from Omdia concludes that tech services distributors drove $16.6 billion in vendor spending in 2024, representing a year-over-year growth rate of 14.5% for the commission-based channel model.

- The lion’s share of gross billings — 72.3% — went through the largest six TSDs, led by Telarus at $2.9 billion, Intelisys at $2.7 billion and Avant at $2.1 billion. Bridgepointe grew the fastest at 32% year over year, aided in part by inorganic growth, while M&A holdout Sandler Partners grew 23.4%.

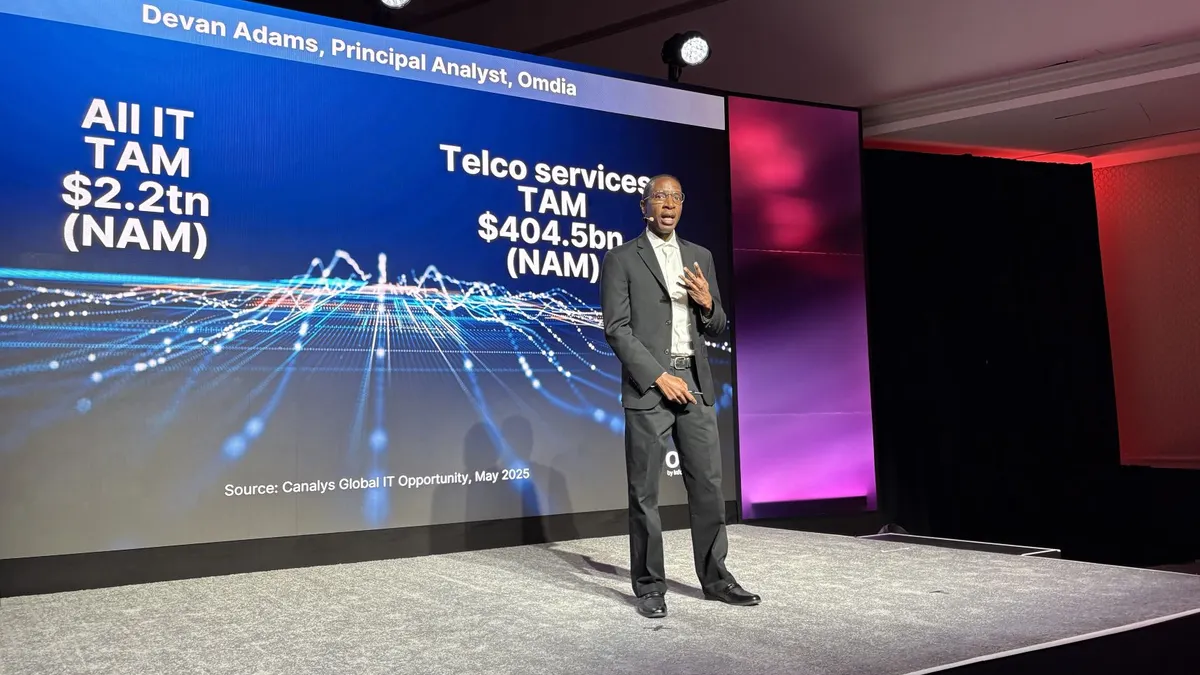

- Two previous TSD-authored reports sized the market in the last year, but Devan Adams’s piece for Omdia is the first to fully break down its numbers. “The secret society called the TSD market is a key player in the channel ecosystem,” Adams told Channel Dive in an email.

Dive Insight:

The report sheds light on the size and growth of the TSD market, which consists of privately held companies with the exception of ScanSource-owned Intelisys.

The study raises new questions about the complex relationships between TSDs and the companies that leverage their vendor agreements and back office.

While Bridgepointe’s $30 billion market size estimate walked backward from the OEMs and service providers that sell through an agency model, Adams analyzed each TSD and benchmarked them against one another to hone in on their approximate sizes.

“During this research, I uncovered some hidden insights like shifts in partner dynamics and growing private equity funding impact, and common convoluted 'hybrid' org structures when TSDs act as agents to other TSDs while also acting as TSDs to other agents — which sounds more confusing just saying it aloud,” Adams said.

Taking a company-by-company approach revealed overlap between national and regional TSDs, as well as large distributors, in which a TSD uses contracts from another TSD to broker for vendors. One of the world’s largest broadline distributors, for example, leans on a TSD for agency-based sales, vendors tell Channel Dive.

TSDs are also deeply nuanced in their downstream relationships with “sub-agent” partners. Technology advisors are most commonly associated with TSDs, but TSDs work with a variety of partner types.

TAs accounted for 76% of TSDs' gross billings in 2024, but value-added resellers and managed service providers accounted for 12% and 7%, respectively. Moreover, the smaller VAR subset often drives the most revenue per deal, making them strategic yet elusive targets for TSD sales teams. VARs and MSPs often view TSDs as their avenue into ancillary telco sales, while TAs broker both telco and IT through TSDs.

Adams estimates that the TSD market grew 10-13% in 2025, slightly below the 2024 growth rate. He wasn’t sure if the market would grow faster in 2026.

“It depends and could easily stay the same growth as 2025, depending on how TSDs attract new partners (VARs, MSPs, SIs, etc.) and diversify suppliers, which they have not done a great job of to date,” he said.

Disclosure: Informa, which owns a controlling stake in Informa TechTarget, the publisher behind Channel Dive, is also invested in Omdia. Informa does not directly influence Channel Dive’s coverage.