The channel is eating itself alive.

Telecom service providers and an army of technology advisors are gnawing at the edges of the traditional IT partner ecosystem, attaching IT to their connectivity sales and grabbing market share from value added resellers in a $405 billion feeding frenzy.

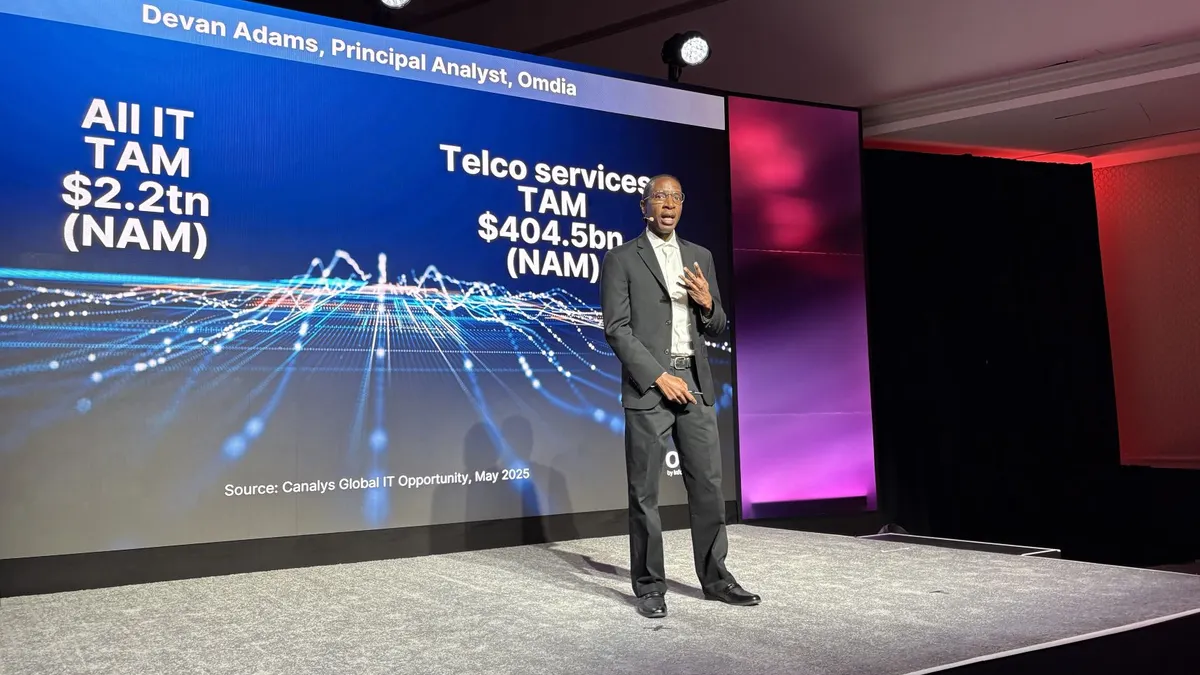

Omdia principal analyst Devan Adams delivered the verdict at Canalys Forum Americas:

"Telco-only partners have become essentially obsolete," he said. By 2028, he predicts that 95% of partner-led telco sales will bundle IT components — an increase from today's 80%.

The competitive threat starts at the vendor level, as incumbent carriers like Comcast and Lumen bundle everything from cybersecurity to SASE platforms in a journey Adams calls “from telco to techco."

And the carriers are selling the bundles at competitive prices that threaten the partners that don’t bundle.

“They'll practically give away the hardware just to get the rest of the business,” said Jim Glackin, Chief Revenue Officer of managed network services provider Coeo Solutions. “For a mid-market systems integrator, what are you going to do? How are you going to compete?”

The carriers are looking for a larger piece of the technology purchasing pie.

According to Canalys estimates, telco spending and IT spending are both growing at more than 6%. However, the IT market is much larger. Telco services account for 18% of the $2.2 trillion total IT spending in North America at $405 billion.

How partners can expand share of telco services

Telcos could be allies to VARs rather than competitors.

The largest ILECs sell the majority of their business revenue directly today, Adams told Channel Dive. Mark Tina, Verizon Business channel chief and VP, indirect partner sales, said at the Channel Partners conference in April that the company has recently increased its percentage of indirect sales to “double-digits.”

But Tina and other carrier executives have said publicly they want to rely more on partners to sell fiber and fixed wireless. The AT&T direct sales force on its own can’t adequately cover the addressable market, AT&T chief operating officer Jeff McElfresh said at the Avant Special Forces Summit last month.

But to date, TAs and tech services distributors are the companies capitalizing on the opportunity. Glackin said TAs have become “millionaires” by selling network services to clients who already work with a VAR.

“Every time you see a really big deal go down in the [advisor/agent] channel, I stop and think, 'Who's the frickin' VAR that has that customer? Where are they? Why have they been asleep at the wheel?'” Glackin told Channel Dive.

Moving from ‘gray market’

Some VARs and MSPs quietly, even informally, maintain a telecom portfolio.

Rather than inking an agreement with a carrier or a tech services distributor, the company may refer its client to a TA partner authorized to broker carrier services. An individual sales rep at the VAR may be responsible for forming the referral agreement, rather than the larger company. Technology Source Chief Revenue Officer Rob Olson calls this dynamic a gray market.

Olson said Technology Source, a TSD, is working to bring partners out of the shadows.

Olson said TSDs need to make it easier for VARs and MSPs to partner with them. One area is financial. Carriers in their agreements with TSDs pay with monthly commissions. Most VARs are more accustomed to a much larger upfront payment, and TSDs may frontload the commission stream to accommodate the VARs. In addition, Olson said Technology Source is building contractual guardrails for MSPs and TAs in its community to collaborate on joint customer accounts without becoming “adversaries.”

“I think there's a value to having a more formal relationship and having it be part of your product set, and obviously you make a lot more money doing that,” Olson told Channel Dive.