Avant’s partners hope the technology services distributor will use new funding to improve its digital platform and give them a competitive advantage in a complex IT purchasing environment.

Avant landed a growth investment from Court Square Capital Partners this week, marking the end of its first private equity cycle with Pamlico Capital. Pamlico, which first bought into Avant in 2021, has reinvested in the company, an unprecedented move for the sector according to multiple partners and vendors consulted by Channel Dive.

With new funding in hand, the TSD is drawing up plans for expansion. The company might open up additional technology practice areas to draw new vendors into the fold and provide technology advisors with sales opportunities, CEO Ian Kieninger said.

Executives are especially bullish about adding AI tooling to Avant’s Pathfinder platform that TAs use to help business customers purchase technology.

“We're going to harness AI to be efficient and to be unique and create value at the customer edge, and the TA is going to use that and help that customer make the decision,” Kieninger told Channel Dive.

TAs like the idea.

Data and APIs are underutilized in the TSD and TA market, but essential in an age of AI-informed purchasing, said Dan Gill, CEO of Massachusetts-based TA Amplix.

“It's tougher for smaller advisors to build great data sets that they can use to help run the business or deliver value to customers,” Gill said. “TSDs have the opportunity with scale to do that. We'd just love to see them continue to double down on the things they're doing on their systems and data projects.”

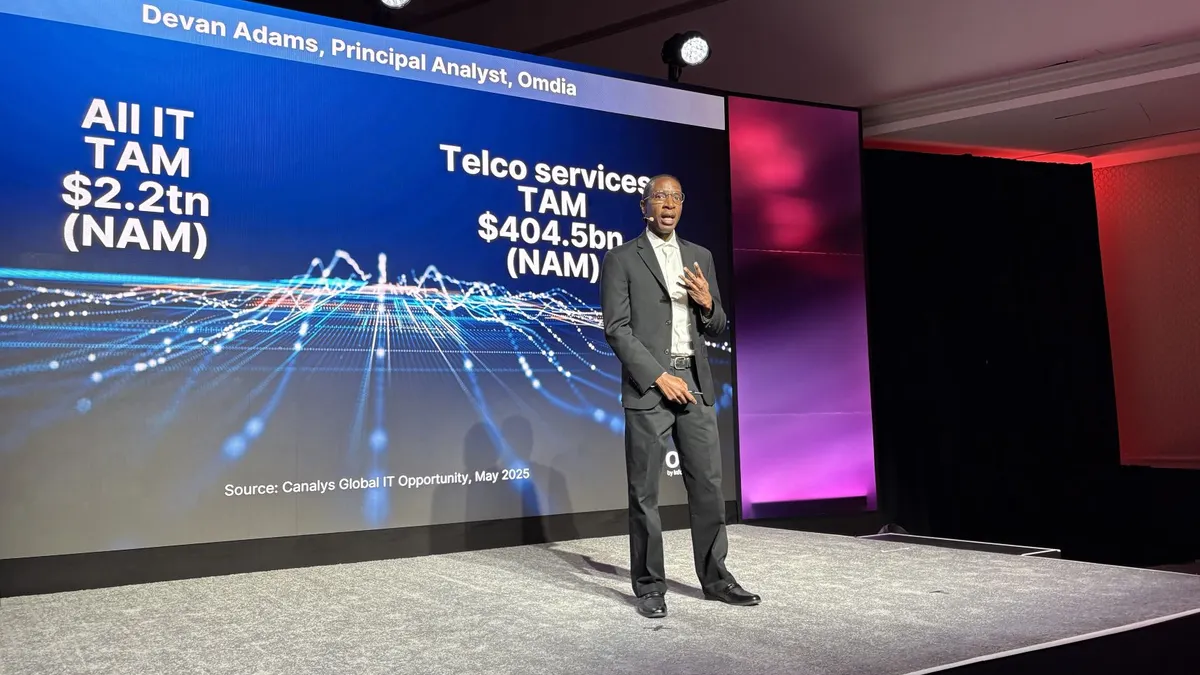

Data in the evolving market

The new TSD value proposition demands deeper data insights.

TSDs such as Avant are the bridge between TAs — who sell products and services to end users — and OEMs and service providers — which use TAs for lead generation. The historical value proposition of a TSD was to give TAs access to contracts with vendors that TAs weren’t large enough to hold on their own, and then pass on sales commissions from the vendors.

However, the role of the TSD is evolving as TAs move beyond telecom services and into advanced IT offerings that require deeper insights. TAs are no longer commodity brokers, according to C3 Technology Advisors President Matthew Toth.

“Version 1.0 of agents was just like, 'Here's three quotes, and I need your help in selecting the vendors.' Version 2.0 is, 'I'm going to run a process, and I'm going to sit by your side throughout this whole thing,’” said Toth, whose company was named Avant’s No. 3 TA at its summit in September. “The more value [TSDs] can add throughout the entirety of this time, the more stuff we're gonna be able to sell.”

Areas for AI advancement

Avant executives said they’ve been laying the foundation to introduce AI tools to the platform.

Over the last two years, Pathfinder underwent a major overhaul of its data model to ingest information more efficiently. TSDs process dozens of third-party data streams for product orders and sales commissions that historically required manual processing. With a data structure in place that understands the company’s business model, Avant can bring AI into the fold.

Toth said the next iteration of Pathfinder needs to automatically input data, so that it isn’t limited by its human interface in how quickly it can add information.

“I want you to have half a dozen to a dozen people that are figuring out how to ingest massive amounts of data and giving us a tool that helps our clients select technology, because if you don't, one of two things can happen,” said Toth. “Either I'm going to find somebody else that can do it, or I'm going to go build it myself. I don't think either of those is a scenario that they would like.”

Prospective investors asked if future end users might bypass TAs and TSDs by getting advice from large language models. Kieninger said Avant isn’t worried about that because Avant possesses the data an LLM requires.

“We have the most domain-specific information to teach a model than anybody in the world, because we’ve been doing 1,500 to 2,000 transactions a month for 16 years,” Kieninger said. “My LLM model, per se, is more valuable than anybody else's.”

Potential new practices

Kieninger said Court Square is keen to help Avant open up new technologies.

The company has launched several practices including data center colocation, unified communications as a service and, more recently, contact center as a service and cybersecurity.

The additions have been successful, Enterprise Visions President and CEO Doug Plooster said.

“I believe Avant has been extremely progressive in the industry as far as recruiting and soliciting partnerships with the leaders in the specific technology arenas that we're trying to provide to customers,” said Plooster, whose company Avant recently named its fastest growing TA.

Software is an area Avant could target with a new practice.

"[Court Square] continues to say, 'Why can't we go wider in terms of the products and technologies we're delivering? Like, what's stopping you from driving harder with CrowdStrike and bringing it to the community?’” Kieninger said. “I’m like, ‘Well, I need your help. Let’s go get them.’”

TAs are interested in a big name software provider like CrowdStrike.

“CrowdStrike moves the needle. CrowdStrike makes the channel even more relevant,” said TechChoice President Paul Storella, who added that TAs need a wide, multicategory portfolio of vendors in order to position themselves as unbiased consultants.

Creating a new practice is costly, requiring a TSD to hire sales engineers and vendor managers. Moreover, the TSD doesn’t make much money on the practice as a first mover.

“What’s expensive for me is to build a practice, take it to market, and then my competition just kind of comes in behind me and does the easy stuff,” Kieninger said.

Court Square’s interest in launching a new practice means it’s willing to be patient, Kieninger said.

Keeping continuity

TAs said they consider it a good sign that Avant’s newest investor is a private equity firm.

It’s an even better sign, they said, that the previous investor wants to remain on board.

“It shows that the investors recognize that the current path of growth still has a lot of tread left on the tires, and there's still a lot of meat left on the bone to continue to grow in the ways that they have in the past, without having to do unnatural things and be consumed inorganically by another distributor or a marketplace,” said Doug Cardozo, partner and chief revenue officer at 3DG Partners, Avant’s No. 2 TA.

Kieninger said Pamlico has offered help to Avant rather than dictate a plan. He said the amenable dynamic will continue with Court Square.

“It's like a round table. The extension to this table just gets bigger for holiday dinner. You put the middle part in, and it's bigger, but it's still circular, and all of us are collaborating together,” he said.