As IT vendors and platforms flood the enterprise market with new services and capabilities, they’re leaning on partners to seize the cross-sell opportunity. Marketplace platform provider AppDirect’s land-and-expand strategy hinges on its network rising to the challenge.

The B2B commerce company has set a goal of generating $1 billion in gross annual recurring revenue within the next two years. The company has added three new “tech wheels” as part of its expansion goals: AI, hardware and logistics, and energy. Acquisition has fueled much of that expansion, with AppDirect buying IT asset management platform Firstbase last December and two energy brokerages this summer. The new product lines join infrastructure, connectivity, mobility, managed services and the original offering in AppDirect’s catalog – software.

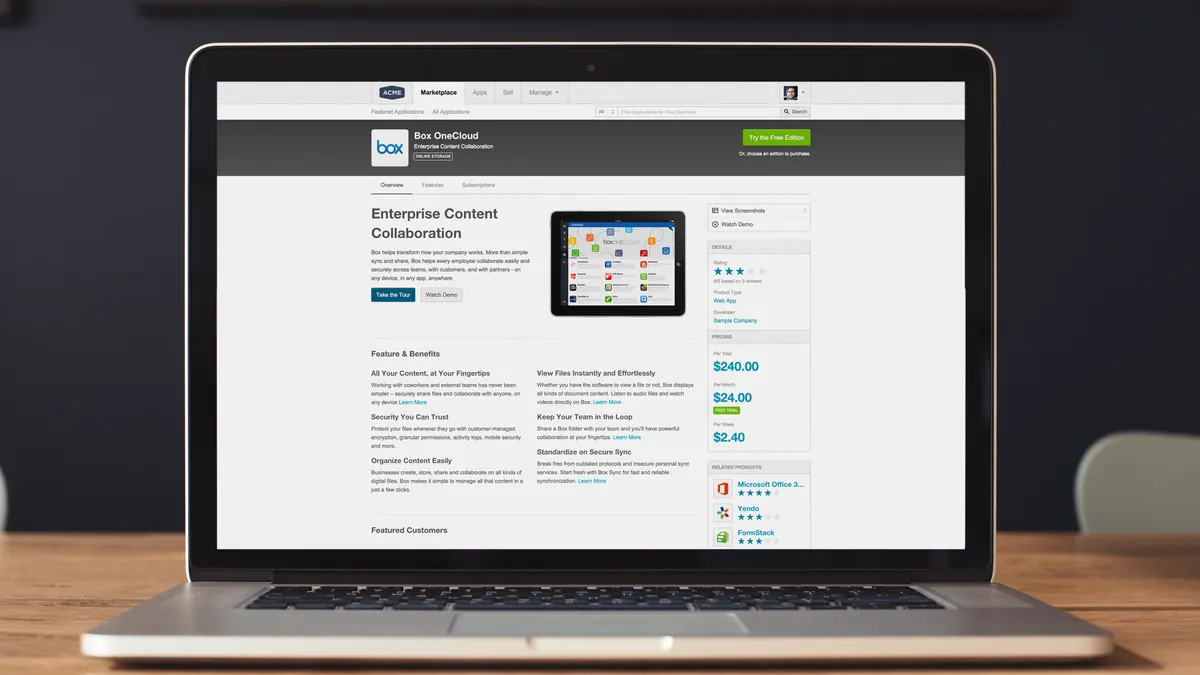

For AppDirect COO Renée Bergeron, the new tech categories represent the next evolution for the company’s technology advisor partners, who have already expanded their telecom-centric portfolio to include cloud. AppDirect invested heavily in the TA market in 2018 when it began acquiring tech services distributors. TAs, also known as agents, sell in a commission-based revenue model and transact through TSDs. TAs historically sold telecommunications, but AppDirect executives bet that agents would adopt AppDirect’s catalog of software-as-a-service products and cross-sell them to their established clients.

Seven years later, AppDirect’s bet is coming to fruition. AppDirect’s cloud business, which includes infrastructure as a service (IaaS) and SaaS, is close to doubling year-over-year.

“That's as a result of partners that traditionally came from the telecommunication space expanding into SaaS and infrastructure as a service,” Bergeron told Channel Dive. “We're nearing 40% of our traditional telecommunication agents that have now sold cloud. So we're far beyond the experimental stage.”

Hardware “as-a-service”

AppDirect acquired Firstbase in December. The IT asset management platform now forms the basis of the company’s hardware and logistics category.

Bergeron said Firstbase, which manages employee device repairs, returns and shipping, found an ideal end user in digitally minded companies with between 200 and 1,000 seats, distributed geographies and remote workers — companies eager to outsource hardware logistics.

Most of AppDirect’s partners don’t sell hardware, preferring recurring software and service revenues. But AppDirect considers Firstbase a hardware-related service rather than a resell product, Bergeron said. While many value-added resellers sell hardware by offering the lowest price, TAs can generate business by solving the end-to-end hardware logistics challenges.

“It brings in the hardware, but it's a service you're selling, as opposed to the hardware,” said Bergeron “That's the beauty of this; it's a differentiated offering that allows them to position against a VAR that will just come in and try to offer a better price.”

AppDirect spent the second quarter of 2025 educating and training partners on Firstbase and have since closed several deals for the platform, according to Bergeron. The company expects that 15% to 20% of its partner community will be selling Firstbase services by the end of 2026.

AppDirect has prioritized lifecycle management capabilities. The company purchased AdCom Solutions’ Network Operations Center and VEEUE cloud monitoring platform in 2023 and mobility and software lifecycle management platform vCom in 2024.

The Energy Opportunity

Now the company is focusing on the AI-strained power grid.

Earlier this year, AppDirect acquired energy brokerages Broker Online Exchange and DNE Resourcess. The company’s Chief Revenue Officer Emanuel Bertolin told Channel Dive he expects 80% of AppDirect’s partner base to be selling energy in the next two years. That number is currently closer to 20%, Bertolin said

Energy has become a priority for businesses and IT teams, moving into the CIO’s purview as AI drives up already elevated electricity prices.

"We feel very bullish that companies that proactively manage their energy portfolio will have a competitive advantage going forward," Bertolin said.

AppDirect is also growing its large language model footprint. The company unveiled devs.ai, an agent-building platform stocked with LLMs from more than 20 providers for partners and end users, in July. The platform contains options from more than 20 LLM providers.

Model choice is baked into AppDirect’s strategy.

“We really see that as the future of LLM deployments inside of companies, because one LLM does not fit all users under a company,” said Rob DeVita, founder and CEO of IT advisory firm Mejeticks. “That's where a trusted advisor can go in and start to monetize the LLM procurement outside of just Copilot or Gemini.”

A growing menu for partners

Agentic automation and other generative AI tools are the latest addition to the cross-sell equation.

The TA model caters well to cross-selling. Suppliers transacting in a TA model do not typically require the partner to earn a certification, and vendors handle the billing and support. Moreover, TAs typically do not need to meet a particular sales volume for the vendor, because they sell through the contract of a much larger TSD. Unburdened by financial risk and technical requirements, TAs often count dozens of vendors in their portfolio. Moving into a new technology category, however, requires time, energy and investment, and partners must convince buyers to entrust them with a new part of the IT stack.

However, cross-selling is paying dividends for partners who have successfully introduced new product lines to their clients.

“Every time an advisor adds a category, they typically sell on average two to three times more than those who don't,” Bergeron said. “And we've seen that for every category added.”

A 2025 Informa TechTarget survey of tech advisors found that 58.4% of their revenue comes from existing clients. Moreover, partners with annual revenues exceeding $5 million drove 68.6% of revenue through existing customers.

Disclosure: Informa, which owns a controlling stake in Informa TechTarget, the publisher behind Channel Dive, is also invested in Channel Dive. Informa has no influence over Channel Dive’s coverage.